Supply Chain Issues and Their Impact

on The International Moving Industry & Its Customers

A White Paper Published by the International Association of Movers

Introduction

There is currently a shipping and supply chain crisis directly affecting every facet of international commerce; its impact far-reaching enough to touch the lives of consumers and businesses everywhere in the world. Simple solutions are not available in our interconnected global economy. While significant industry efforts are underway to highlight the issues and draw attention to them, the plight of the international moving industry and its customers will barely register as a blip on the radars of government regulators.

The intent of this paper is to expound on the wide-ranging impacts of this global crisis on the moving industry and its corporate, government, and private moving services consumers. It is IAM’s hope that this will lead all parties to have a better understanding of the problem and promote a collaborative environment where key players can find answers and solutions to this complex issue.

The Cause of the Crisis

The following estimates reveal the reality of container trade imbalances in the current international commerce:

- Over 90% of the total volume of world cargo is transported by Containerized cargo makes up more than 70% of this sea shipment volume.

- More than 17 million shipping containers are in circulation. Out of this number, only around 6 million are available for cargo transport. The remaining majority is utilized for storage and other local

The supply chain has always struggled to keep up with these challenges, but the arrival of the COVID- 19 Virus and the ensuing global pandemic set in motion a perfect storm that has severely impacted every aspect of global commerce including the international household goods shipping industry.

Container Imbalances

A Transmetric Blog post cites some staggering statistics from the Boston Consulting Group: 1 in 3 containers, globally, is repositioned empty, costing the shipping industry up to US$20 billion per year. Major ports, like Los Angeles, are estimated to move over 50% of their containers empty due to trade imbalances between Asia (China, in particular) and the rest of the world.

The problem is not new. What is new though is that an already declining global trade environment was exacerbated by the Covid-19 pandemic.

In April 2020, the Organization for Economic Co-operation and Development (OECD) published a brief that reported a dramatic decline in global container trade volumes, especially from China where the government, in a move to curb the spread of the virus, strictly enforced lockdowns and factory closings. The unforeseen drop in business forced shipping companies to reduce capacity to reduce costs.

By November 2020, Chinese factories were back in business reopening the doors for exports. China’s early response efforts paid off (NBC News, November 7, 2020 article). This quick economic rebound created a surge in container demand causing the shipping industry to swiftly unwind its previous decision to reduce capacity.

The unexpected export decline/surge situation, happening within months of each other, only exacerbated what was already a problematic container imbalance.

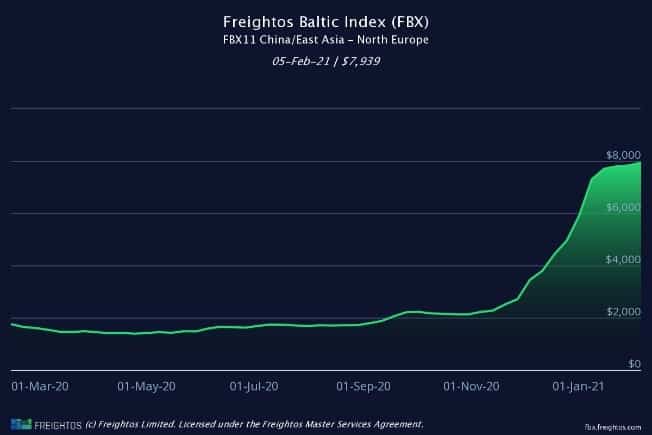

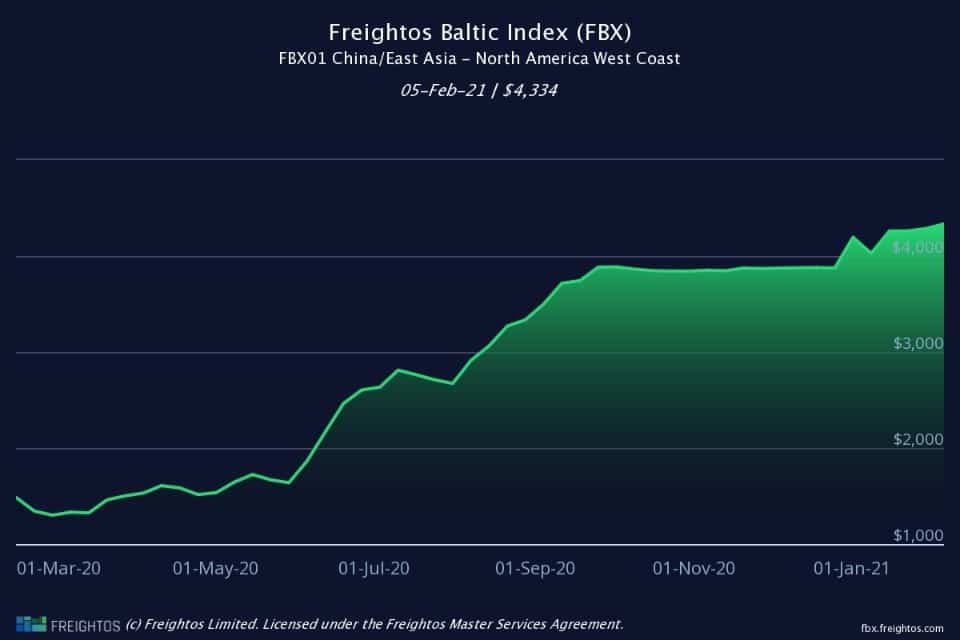

The shipping industry responded to this imbalance in a number of ways. In particular, they raised freight rates from Asia (See Chart Below), which created ripple effects around the world.

As container shipping prices from Asia escalated, shipping lines started to refuse bookings for exports from American and European companies preferring instead to quickly reposition empty containers for reuse in Asia. This culminated in investigations by the Federal Maritime Commission into the practices of the shipping lines. (February 3, 2021 article in Freightwaves). The International Association of Movers (IAM) supports this investigation and is seeking relief on behalf of its members and clients, so they are neither assessed detention and demurrage charges or freight surcharges connected to congestion, trucking, or equipment shortages.

Effect on Shipping Rates

The end of 2020 would see spot rates for 40’ Containers (FEU) going as high as US$10,000 from China to the US East Coast port. Spot rates are said to now hover above US$12,000 per FEU from Singapore to Felixstowe, UK. (Source: Freightwaves, December 21, 2020). A Bloomberg.com article dated January 13, 2021, reports that container rates that were once US$2000 across the Pacific are now as high as

$13,000., with no sign in sight that the astronomical rates will improve in 2021.

We know that these shipping costs have a huge effect on what we ultimately pay for consumer goods. But what of its impacts on moving consumers? International moving companies typically quote door-to-door rates that include ocean freight with a validity period of 30-to-60-days. While shipping rates expectedly fluctuate during such validity periods, the industry has never had to deal with increases of 20% to 50%. There is little choice but to pass on these underlying rate increases to moving consumers who are already suspicious of the slightest increases, regardless of what explanation they are given.

For corporate and government clients as well as for Global Relocation Companies, international moving companies typically file contracted rates for door-to-door services that have a validity period of 6 months to two years. Factoring in underlying cost fluctuations while remaining competitive has always been a challenge for the moving industry but in the current environment, absorbing ocean freight increases is simply not possible. As a result, international moving companies are faced with only two choices; either walk away from business or struggle with severe cash flow impacts.

For everyone involved, the impact is severe.

Port Congestion Issues

Along with steamship containers, ports, inland drayage, and container handling equipment like container chassis are part of the seamless, interconnected infrastructure of international transport and commerce. The world’s leading container ports struggled to respond to the fall in container volume only to be faced with an unprecedented spike causing similarly unprecedented port congestion issues.

A back-up of over 35 ships waiting to berth at Los Angeles and Long Beach is cited in a Supply Chain Dive article dated January 14, 2021. The surge in import volumes coupled with labour shortages due to the pandemic are to blame. Inter-terminal truckers who move containers from the port to customer locations are likewise heavily impacted as they are unable to obtain appointments to pick up containers.

A shortage of chassis availability worsens the problem. Without the chassis (wheels) required to haul the containers, the containers are stuck in terminals while the clock ticks away and the time allotment for unloading containers runs out. This delay in container movement adds to the container shortage issue.

For moving consumers, it is hard to accept delays in their shipment schedules and harder even to agree to shoulder the additional charges incurred due to such delays.

CONCLUSION

This situation, like so many consequences, brought about by the Covid-19 pandemic, is not a result of poor planning or greed. The wider shipping and transport industries, as well as the moving industry, are adapting and adjusting in response to these unprecedented conditions but until we reach a new state of normalcy, the industry and its customers must work together to get through this together.

About the International Association of Movers

The International Association of Movers (IAM) is the moving and forwarding industry’s largest global trade association. With more than 2,000 members, it comprises companies that provide moving, forwarding, shipping, logistics, and related services in more than 170 countries. Since 1962, IAM has been promoting the growth and success of its members by offering programs, resources, membership protections, and unparalleled networking opportunities to enhance their businesses and their brands.

To download the IAM White paper: Supply Chain Issues Impacting International Moving Industry A4